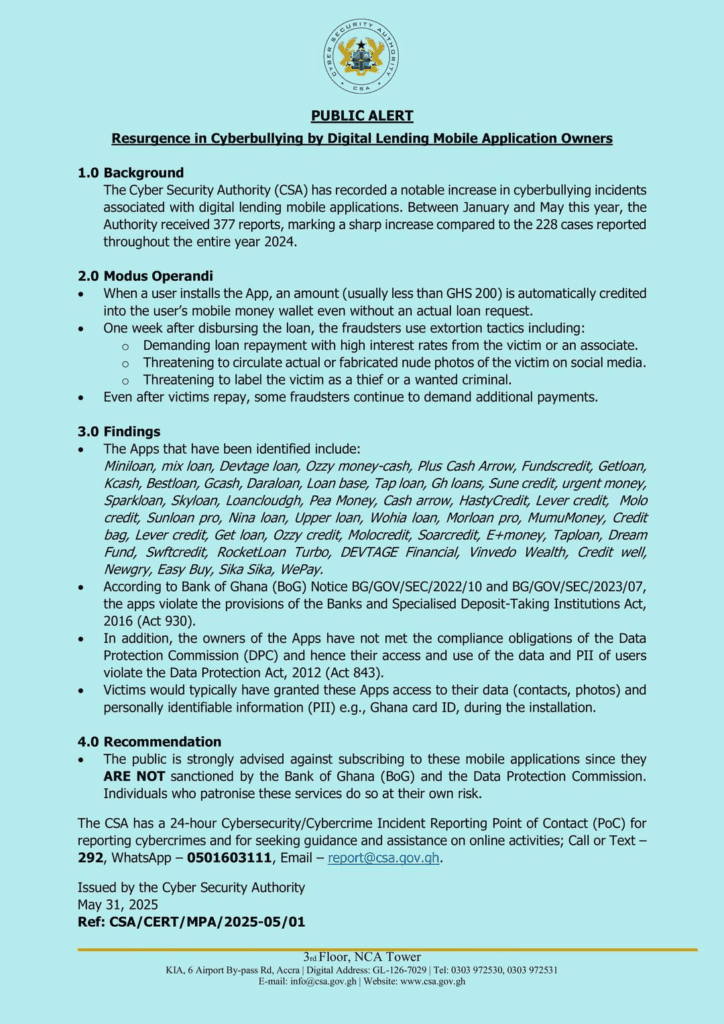

The Cyber Security Authority has disclosed that it has recorded cyberbullying incidents associated with digital lending mobile applications.

The Authority, in a statement, disclosed that it has received 377 reports between January and May 2025, which is a sharp increase from the 228 cases reported in the entire year of 2024.

The modus operandi of the apps, the authority said, is to automatically credit the user’s mobile money with Ghc200 when they have not requested the money.

One week after disbursing the loan, the alleged fraudsters use extortion tactics, including the fabrication of nudes of the victims on social media.

According to the authority, even after the victims had finished paying the money, the alleged fraudsters continued to demand additional payments.

The apps identified to be engaging in these activities the institution said include Miniloan, Mix Loan, GCash, Daraloan, Loan Base, Tap Loan, Sune Credit, Urgent Money, KCash, Bestloan, Pea Money, Cash Arrow, HastyCredit, and Lever Credit.

The rest are Upper loan, Spark loan, Sky Loan, Turbo, Soarcredit, Taploan, Dream Fund, Swiftcredit, Rocketloan Turbo, DEVTAGE Financial, WePay, Newgry, Easy Buy, Sika Sika, Upper loan, Sunloan pro, Loancloudgh, Pea money, Wohia Loan, E+money, Mumumoney, Taploan, Vinvedo Wealth, Credit Well, Ozzy credit, Morloan pro and Credit bag.

The apps and their owners have not met the compliance obligations of the Data Protection Commission (DPC); hence, their activities breached the Data Protection Act, 2012 (Act 843).

The Authority has therefore advised the Ghanaian public to desist from subscribing to these mobile applications since they are sanctioned by the central bank and the Data Protection Commission.

By: Rainbowradioonline.com/Ghana