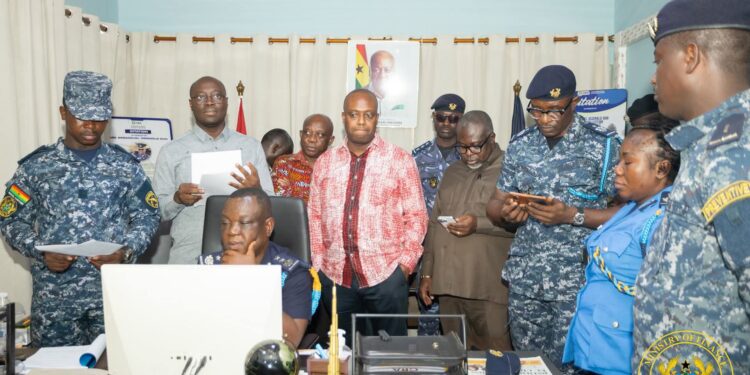

Finance Minister Dr. Cassiel Ato Forson has launched an investigation into the Customs Division of the Ghana Revenue Authority after uncovering an alleged transit diversion scheme involving 18 trucks and potential tax evasion of GHS 85 million.

The Minister, who visited the Akanu and Aflao border posts today, revealed that a suspected smuggling ring attempted to evade over GHS 85 million in taxes by falsely declaring goods as being “in transit” to Niger.

The operation began on Wednesday night when Customs officials intercepted the fleet, which was carrying over 44,000 packages weighing nearly 880,000 kilograms.

Although the trucks were officially cleared at the Akanu Border for exit at Kulungugu, intelligence surveillance discovered they were moving without the mandatory Customs Human Escorts required by law.

”Preliminary findings point to systemic control weaknesses and human complicity,” Dr. Forson stated. “We will not allow Ghana’s customs regime to be exploited to undermine domestic revenue mobilization.”

Currently, 12 trucks have been impounded. Eleven are secured at the Tema Transit Yard, while one truck overturned and spilled its cargo while attempting to escape authorities. A manhunt is currently underway for the remaining six vehicles.

Initial assessments placed the suspended duties at approximately GHS 2.6 million.

However, a post-interception audit revealed massive discrepancies in unit values and tariff classifications, skyrocketing the actual revenue exposure to GHS 85,306,578.33.

The Ministry confirmed that the impounded goods will be auctioned according to the law to recover lost value.

”Every cedi matters in our collective effort to fund national priorities,” Dr. Forson added, adding that the government remains resolute in protecting local industries from unfair competition and smuggling.

Below is the full statement

Earlier today, I visited the Akanu and Aflao border posts following the interception of articulated trucks suspected to be involved in a transit diversion scheme.

On Wednesday night, the Ghana Revenue Authority, through its Customs Division, intercepted eighteen articulated trucks declared as goods in transit to Niger.

Intelligence and field surveillance established that these trucks were moving without the mandatory Customs Human Escorts required under our transit protocols.

The trucks had been released from the Akanu Border Post for transit through the Eastern Corridor, with exit designated at Kulungugu en route to Niger under Bill of Entry Number 80226125039.

The declared cargo comprised 44,055 packages weighing 879,860 kilograms.

As of now, twelve of the eighteen trucks have been impounded.

Eleven are secured at the Tema Transit Yard for detailed inspection, investigation, and further legal processing.

One truck overturned while attempting to evade interception, spilling its cargo.

The remaining six trucks are being actively pursued.

Initial suspended duties and taxes were assessed at GHS 2,619,748.81. However, post-interception examinations revealed material discrepancies in declared unit values, tariff classifications, and weights.

These irregularities significantly understated the tax liability.

The revised suspended revenue exposure now stands at GHS 85,306,578.33.

Preliminary findings point to systemic control weaknesses and human complicity.

I have therefore directed the Ghana Revenue Authority to undertake comprehensive investigations without delay.

Any Customs officer found culpable will face prompt disciplinary action in accordance with the law.

Criminal investigations will also extend to importers and clearing agents where evidence supports prosecution.

The full rigours of the law will be applied.

The impounded goods will be auctioned strictly in accordance with applicable laws.

In response to this abuse of the transit regime, I have directed the Ghana Revenue Authority to implement the following immediate measures:

- All land transit of cooking oil is hereby prohibited. Such consignments must be routed exclusively through Ghana’s seaports.

- All transactions originating from land collection points will be subjected to enhanced monitoring, tracking, and strict compliance enforcement to safeguard state revenue.

- prompt commencement of disciplinary measures and legal prosecution of Customs officers found culpable in similar circumstances.

Government remains resolute in safeguarding local industry and jobs.

We will not allow Ghana’s customs regime to be exploited to undermine domestic revenue mobilisation and national development.

Every cedi matters in our collective effort to fund national priorities.

By: Rainbowradioonline.com/Ghana